2. the entity translates all foreign currency items into its functional currency. 3. the entity reports the effects of such translation in accordance with paragraphs [reporting foreign currency transactions in the functional currency] and 50 [reporting the tax effects of exchange differences] ifrs 9 financial instruments introduction bcin.1 scope (chapter 2) bcz recognition and derecognition (chapter 3) bcz classification (chapter 4) bc measurement (chapter 5) bcz hedge accounting (chapter 6) bc effective date and transition (chapter 7) bc analysis of the effects of ifrs 9 bce.1 general bcg.1 dissenting opinions IFRS 9), a contract to buy or sell a non-financial item such as commodity (see paragraphs – and BA.2 of IFRS 9) or a contract settled in an entity’s own shares (see paragraphs 21–24 of IAS 32). Therefore, an entity must evaluate the contract to determineFile Size: KB

IFRS 9 — Financial Instruments

You need to Sign in to use this feature. An entity may carry on foreign activities in two ways. It may have transactions in foreign currencies or it may have foreign operations. IAS 21 prescribes how an entity should:. The principal issues are which exchange rate s to use and how to report the effects of changes in exchange rates in the financial statements.

Any other currency is a foreign currency. In April the International Accounting Standards Board Board adopted IAS 21 The Effects of Changes in Foreign Exchange Rateswhich had originally been issued by the International Accounting Standards Committee in December IAS 21 The Effects of Changes in Foreign Exchange Rates replaced IAS 21 Accounting for the Effects of Changes in Foreign Exchange Rates issued in July In December the Board issued a revised IAS 21 as part of its initial agenda of technical projects.

The Board amended IAS 21 in December to require that some types of exchange differences arising from a monetary item should be separately recognised as equity.

Other Standards have made minor consequential amendments to IAS They include Improvements to IFRSs issued MayIFRS 10 Consolidated Financial Statements issued MayIFRS 11 Joint Arrangements issued MayIFRS 13 Fair Value Measurement issued MayPresentation of Ifrs 9 forex of Other Comprehensive Income Amendments to IAS 1 issued JuneIFRS 9 Financial Instruments Hedge Accounting ifrs 9 forex amendments to IFRS 9, IFRS 7 and IAS 39 issued NovemberIFRS 9 Financial Instruments issued JulyIFRS 16 Leases issued January and Amendments to References to the Ifrs 9 forex Framework in IFRS Standards issued March This website uses cookies.

You can view which cookies are ifrs 9 forex by viewing the details in our privacy policy. Phrase search. Word search. About us Who we are. Our structure. Working in the public interest. How we set IFRS Standards. Our consultative bodies, ifrs 9 forex. Contact us, ifrs 9 forex.

Why global accounting standards? Use of IFRS Standards by jurisdiction, ifrs 9 forex. Adoption and copyright. News and resources. Publication: Use of IFRS Standards around the world [PDF]. IFRS Standards. The IFRS for SMEs Standard. IFRS Translations. Editorial corrections. IFRS Taxonomy. Supporting materials for IFRS Standards.

Supporting consistent application. Supporting materials for the IFRS for SMEs Standard. Work plan. Post-implementation Reviews. Pipeline projects. Open for comment. Better Communication in Financial Reporting. Completed projects. IFRS Foundation news. IFRS Foundation Updates. Meetings and events calendar. IFRS Foundation speeches. IFRS Foundation podcasts. Follow - IAS 21 The Effects of Changes in Foreign Exchange Rates ×. SHOW SECTIONS. IAS 21 permits an entity to present its financial statements in any currency or currencies.

Standard history. Related active projects Lack of Exchangeability Amendments to IAS Related IFRS Standards. Related IFRIC Interpretations IFRIC 16 Hedges of a Net Investment in a Foreign Operation SIC-7 Introduction of the Euro. Unconsolidated ifrs 9 forex. Implementation support IAS 21 The Effects of Changes in Foreign Exchange Rates.

IFRS 9 - Classification and Measurement of Financial Assets and Financial Liabilities IFRS lectures

, time: 41:55IFRS - IAS 21 The Effects of Changes in Foreign Exchange Rates

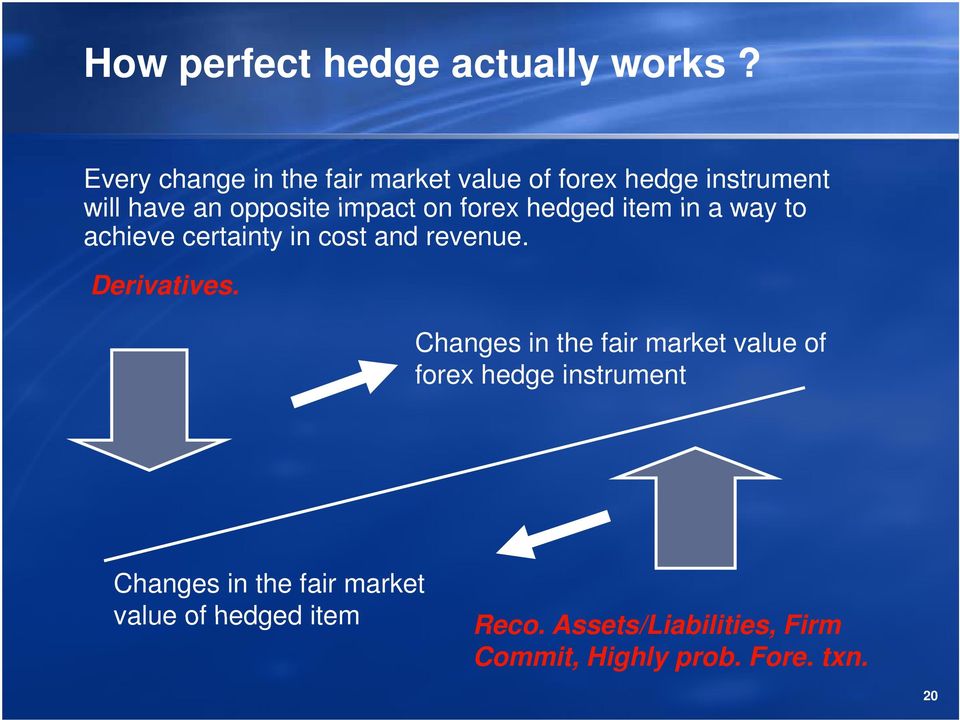

They include Improvements to IFRSs (issued May ), IFRS 10 Consolidated Financial Statements (issued May ), IFRS 11 Joint Arrangements (issued May ), IFRS 13 Fair Value Measurement (issued May ), Presentation of Items of Other Comprehensive Income (Amendments to IAS 1) (issued June ), IFRS 9 Financial Instruments (Hedge Accounting and amendments to IFRS 9, IFRS 7 and IAS 39) (issued November ), IFRS 9 Financial Instruments (issued July ), IFRS The most significant effect of IFRS 9 Financial Instruments for non-financial entities will be the application of the new hedge accounting model. This model is less rules-based than the model set out in IAS 39 Financial Instruments: Classification and Measurement and should enable a wider range of economic hedging strategies to achieve hedge accounting FOREX financial assets: assessment is made in the denomination currency (i.e. FX movements are not taken into account). IFRS 9 contains various illustrative examples in the application of both the (i) Business Model Assessment and (ii) Contractual Cash Flow Characteristics. (3) Fair value through other comprehensive income Equity Instruments

No comments:

Post a Comment