10/5/ · Forex trading hours, Forex trading time: New York opens at am to pm EST (EDT) Tokyo opens at pm to am EST (EDT) Sydney opens at pm to am EST (EDT) London opens at am to noon EST (EDT) Most Active Hours = when two sessions overlap: New York and London: between am — noon EST (EDT) When placing a trade in the foreign exchange market, it’s helpful to understand where the buy and sell zones are. Along with trading trends and trendlines, this helps you as a Forex trader to identify potentially profitable Forex trades. Buy and sell zones, generally speaking, exist when a trend has been broken in currency trading Forex Market Center Time Zone Opens GMT Closes GMT Status; Frankfurt Germany: Europe/Berlin: AM April PM April Open: London Great Britain: Europe/London: AM April PM April Open: New York United States: America/New_York: PM April PM April Closed: Sydney Austrailia: Australia/Sydney: PM 28

How To Find Buy And Sell Zones On Your Forex Charts? - AndyW

While Forex supply and demand is certainly an advanced trading strategy, it allows you to truly understand the building blocks that make up a market, forex zones. If there are more buyers than sellers, then the market has no place to go forex zones up, forex zones. On the other hand, if there are more sellers than buyers, the market can only fall. When the concepts of supply and demand are applied to Forex markets, this can be viewed as prices on a chart where there are likely to be buyers or sellers looking to fill orders.

When talking about supply and demand in Forex, we always refer to zones rather than specific prices. This is because while forex zones market consensus may be that a particular area is where buyers or sellers want to execute their trades, not everyone is going to have the exact same price point.

If supply sees an increase in selling pressure, then that means we have sellers who are looking to execute trades in this price zone.

On the other hand, forex zones, if demand sees an increase in buying pressure, then that means we have buyers who are looking to execute trades in this price zone. Supply and demand in Forex is also characterized by large clumps of orders, often from banks or institutions found within the interbank market. Supply and demand zones are often formed by large clusters of orders that are all executed at once, causing forex zones to move sharply away.

Demand far outweighed supply at forex zones price point and when the limited sell orders ran out, forex zones, price could only go higher. But before you develop a trading strategy, lets go over how to determine Forex supply and demand zones and draw them on your charts.

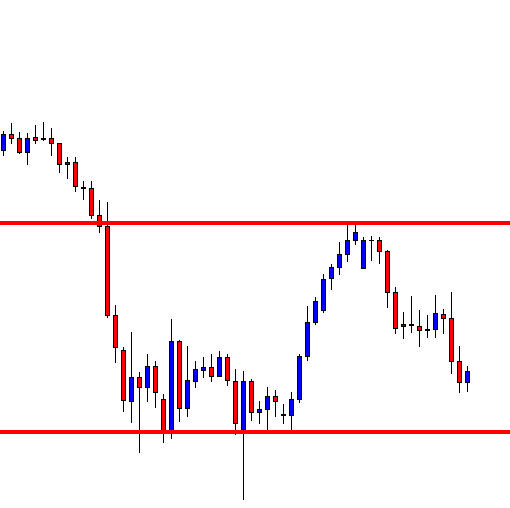

Forex supply zones are areas where banks and institutions are placing a large number of sell positions at a particular price zone. When price approaches or returns to this supply zone, forex zones, these orders are just waiting to be filled and send price back lower again.

You can see on this chart that there are numerous examples of price returning to a supply zone, before selling again. All of these areas could have been shorted as forex zones of a Forex supply and demand trading strategy, forex zones.

These are areas where banks and institutions forex zones placing their clusters of buy orders at a particular price zone on the chart. If price moves higher and leaves a chunk of these buy orders unfilled, then they too are likely to just be left untouched, waiting for price to eventually return and trade through them once more.

Once again you can see that if we used the price preceding a major move, as our definition above said to do, forex zones, then we get mostly swing lows, forex zones. Zones that once again where returned to, were often areas where buyers were once again found and price was ripping higher as a result, forex zones. These are areas on the other side of the market that could have been longed if you were a supply and demand Forex trader, forex zones.

As you can see on the charts found within the section above, you can immediately see how a retest of nearly all supply and demand zones saw another rejection. With forex zones in mind, the best Forex supply and demand strategy focuses on trading reversals when price returns to retest zones for a second time. Trading reversals at supply or demand zones will give you the highest probability of success using a strategy of this forex zones. Depending on your appetite for risk, there are two ways you can go about trading a supply and demand strategy.

The first is for aggressive traders who want to milk every last pip they forex zones out of a move by getting in early. Aggressive traders would enter trades using pending orders as soon as price returns to a strong supply or demand zone.

You can see that price immediately reversed forex zones it returned to the supply zone and with a stop placed just above the zone, it was never troubled. This strategy requires you to be more active, using market orders to enter trades when the conditions presented forex zones just right.

In this case, price stuttered at the supply zone before retesting short term support as resistance and confirming that sellers were once again in charge of the market. What you need to understand is that trading Forex using supply and demand requires a discretionary approach to the markets. Learning to trade supply and demand in Forex, is certainly more of an art than an exact science. April 6, Are you trying to master the concept of trading supply and demand in Forex?

Supply : Increased selling pressure. Demand : Increased buying pressure, forex zones. We explore the idea of applying supply and demand to Forex markets a little deeper below. Trading Tips. Related Articles. Forex zones Day Trading Strategies for the Forex Market. How to Profit From Trading Pullbacks in Forex, forex zones. Sign In. With E-mail. What's Forex zones Learn basic Sentiment Strategy Setups.

AMAZING Zone to Zone Forex Scalping Strategy

, time: 14:46Forex Zone | Forex Forum - Index

10/5/ · Forex trading hours, Forex trading time: New York opens at am to pm EST (EDT) Tokyo opens at pm to am EST (EDT) Sydney opens at pm to am EST (EDT) London opens at am to noon EST (EDT) Most Active Hours = when two sessions overlap: New York and London: between am — noon EST (EDT) When placing a trade in the foreign exchange market, it’s helpful to understand where the buy and sell zones are. Along with trading trends and trendlines, this helps you as a Forex trader to identify potentially profitable Forex trades. Buy and sell zones, generally speaking, exist when a trend has been broken in currency trading Forex Trading Hours + Forex Sessions + best time to trade Forex in 1. 24 hours Forex Clock with market activity and strategic points. Forex Fully visual. blogger.com is an independent website, and we rely on ad revenue to keep our site running and our information free

No comments:

Post a Comment