8. · He wants to buy a stock named ABC and enters the market. The current market price is $10, the Bid price is $, and the Ask price is $ So, $ is the lowest price sellers are willing to sell the stock at, and $ is the highest price buyers are willing to buy the stock at 3. 9. · Forex Update: As of , these are your best and worst performers based on the London trading schedule: ����CAD: % ����GBP: % ����EUR: % ����AUD: % 4. · If we want to learn when to buy and sell in forex first, we need to know base terms. What buying and selling on forex means When it comes to purchasing and selling pairs on forex, this entails estimating an appreciation or depreciation concerning the value of one type of currency compared to another type of currency

How to Trade Forex | Trading Examples - blogger.com

When to buy and sell Forex? With Forex you can trade with upward or downward price trends with equal ease. But how do you know when to buy, and when to sell, and what means are there to be certain that you are making the right move?

In this article, we will explore the various factors that will affect price changes on the currency markets, as well forex to buy some strategies that can help you enhance your trading career when buying and selling Forex. Just like stocks, you can trade currency based on what determine its current value to be, or what you think its value will be at some future point. In other words, if you think a currency will increase in value, you can buy it. If you forex to buy it will decrease, you can sell it, forex to buy.

EUR, the first currency in the pair, is the base, and USD, the second, is the counter, forex to buy. When you see a price quoted on your platform, that price is how much one euro is worth in US dollars. You always see two prices because one is the buy price and one is the sell, forex to buy. The difference between the two is the spread, forex to buy.

When you click buy or sell, you are buying or selling the first currency in the pair. For example, the most actively traded currencies in the forex market consist of the U. The current foreign exchange market is clearly dominated by the U. The most actively traded currency pair in the forex market consists of the Euro against the U. Dollar or EURUSD currency pair.

The second most actively traded currency pair is the U. Dollar against the Japanese Yen or USDJPY, forex to buy, and the third most actively traded currency pair is the U. Pound Sterling against U. Dollars or GBPUSD, also known as Cable. The symbols assigned to the different currencies consist of three letter codes called ISO codes that are assigned by forex to buy International Organization of Standards.

The first two letters in the code generally consist of the ISO country code also sometimes known as the Internet country codewhile the last letter is the first letter of the currency. For example, the U. Pound Sterling is GB which is the ISO country code for Great Britain and P which stands for Pound. Many other countries exist in the world, forex to buy, and most of them have their own currencies.

Exotic currencies are made up of the hundreds of currencies not in the major or minor leagues, but which are nevertheless important as well, especially in international commerce and finance.

The two main factors that forex to buy the movements in one exchange rate are capital flows and trade flows. These two components constitute what economics call balance of payments.

The main purpose of the balance of payments is to quantify the demand and supply for a currency of one country, over a period of time. A negative balance of payments indicates that the capital leaving the country is greater than the capital entering the country not much demand, forex to buy.

A positive balance of payments means that the capital entering the economy is greater than the capital leaving the economy increasing demand of the domestic currency, forex to buy.

Capital flows is the net quantity of currency traded bought or sold through capital investments. Physical Flows happen when foreign entities sell their local currency and buy foreign currency to make foreign direct investments for forex to buy ventures, acquisitions, etc, forex to buy. When the volume of this kind of investment increases, forex to buy, it reflects the good shape and health of the economy where it is invested.

Portfolio investments are those which are made on global markets, variable and fixed income market investments Forex, stocks, T-bills, etc. An example of portfolio investments is when a hedge fund in Japan invests in the US equity markets. Trade flows measure the net exports and imports of a given country. These two components exports and imports constitute what economists call the current account.

Countries that have a positive current account exports greater than imports are more likely to depreciate their currency; this way the consumer abroad will perceive the foreign currency to be cheaper and can purchase more goods and services.

On the other hand, countries that have a negative current account imports greater than exports are more likely to appreciate their currency since they need to sell the local currency and buy foreign currency in order to purchase goods and services.

This theory states that exchange rates are determined by the relative prices of a similar basket of goods in different countries. Forex to buy other words, the ratio of prices of a basket with similar goods of two countries should be similar to forex to buy exchange rate. If the exchange rate was at 1. On the other hand, if the exchange rate was at 1. The major weakness of this theory is that it assumes that there are no costs related to the trade of goods tariffs, taxes, etc.

Another weakness is that it does not consider other factors that might influence the exchange rate i. interest rates etc. Modern monetary theories include the capital markets to the PPP theory arguing that capital markets have less costs of trading. This theory states that interest rates differentials neutralize the increase or decrease of any currency against another currency.

Therefore there are no arbitrage opportunities. For instance if the interest rate of Australia is 6. There are also other theories that try to explain the value of a currency pair.

But as with every theory, they are based on assumptions that may or may not be present in the real world. A forex trading strategy defines a system that a forex to buy trader uses to determine when to buy or sell a currency pair. There are various forex strategies that traders can use including technical analysis or fundamental analysis.

A good forex trading strategy allows for a trader to analyse the market and confidently execute trades with sound risk management techniques. Price action trading involves the study of historical prices to formulate technical trading strategies. Price action can be used as a stand-alone technique or in conjunction with an indicator. Fundamentals are seldom used; however, it is not unheard of to incorporate economic events as a substantiating factor.

Range trading includes identifying support and resistance points whereby traders will place trades around these key levels. This strategy works well in market without significant volatility and no discernible trend. There is no set length per trade as range bound strategies can work for any time frame. Managing risk is an integral part of this method as breakouts can occur.

Consequently, a range trader would like to close any current range bound positions. Oscillators are most commonly used as timing tools. Relative Strength Index RSICommodity Channel Index CCI and stochastics are a few of the more popular oscillators. Price action is sometimes used in conjunction with oscillators to further validate range bound signals or breakouts.

Trend trading is a simple forex strategy used by many traders of all experience levels. Trend trading attempts to yield positive returns by exploiting a markets directional momentum.

Trend trading generally takes place over the medium to long-term time horizon as trends themselves fluctuate in length. As with price action, forex to buy, multiple time frame analysis can be adopted in trend trading.

Entry points are usually designated by an oscillator RSI, CCI etc and exit points are calculated based on a positive risk-reward ratio. Using stop level distances, traders can either equal that distance or exceed it to maintain a positive risk-reward ratio e. If the stop level forex to buy placed 50 pips away, the take profit level wold be set at 50 pips or more away from the entry point.

Position trading is a long-term strategy primarily focused on fundamental factors however, technical methods can be used such as Elliot Wave Theory. Smaller more minor market fluctuations are not considered in this strategy as they do not affect the broader market picture. This strategy can be employed on all markets from stocks to forex.

As mentioned above, forex to buy, position trades have a long-term outlook weeks, months or even years reserved for the more persevering trader.

Understanding how economic factors affect markets or thorough technical predispositions, is essential in forecasting trade ideas.

Entry and exit points can be judged using technical analysis as per the other strategies. Day trading is a strategy designed to trade financial instruments within the same trading day. That is, all positions are closed before market close. This can be a single trade or multiple trades throughout the day. Trade times range from very short-term matter of minutes or short-term hoursas long as the trade is opened and closed within the trading day, forex to buy.

Scalping in forex is a common term used to describe the process of taking small profits on a frequent basis. This is achieved by opening and closing multiple positions throughout the day. The most liquid forex pairs are preferred as spreads are generally tighter, making the short-term nature of the strategy fitting. Like most technical strategies, identifying the trend is step 1. Many scalpers use indicators such as the moving average to verify the trend. Using these key levels of the trend on longer time frames allows the trader to see the bigger picture.

These levels will create support and resistance bands. Scalping within this band can then be attempted on smaller time frames using oscillators such as the RSI. Stops are placed a few pips away to avoid large movements forex to buy the trade. Swing trading is a speculative strategy whereby traders look to take advantage of rang bound as well as trending markets. Swing trades are considered medium-term as positions are generally held anywhere between a few hours to a few days.

Longer-term trends are favoured as traders can capitalise on the trend at multiple points along the trend, forex to buy. The only difference being that swing trading applies to both trending and range bound markets.

This exceptional liquidity ensures reliable pricing even at high volumes and enables the tightest possible dealing spreads, forex to buy. When you trade forex your trading costs are comparatively low, and you can easily go long or short of any currency.

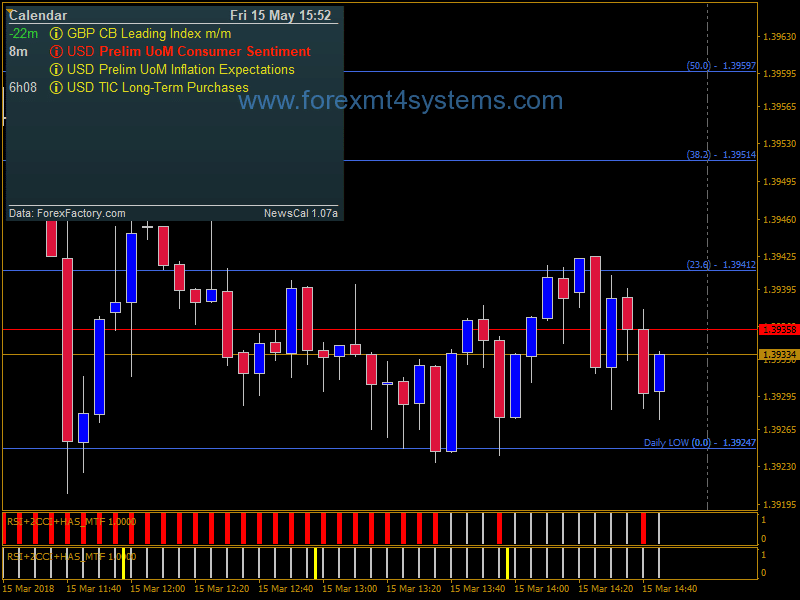

Forex Trading For Beginners. BUYING OR SELLING - Making Money with MT4

, time: 15:07Forex Market News & FX Forecast

BookMyForex, India's leading and largest marketplace for retail foreign exchange and private remittances. BookMyForex is revolutionizing the way foreign exchange is bought and sold in India. Now, buy foreign exchange at zero exchange margin. BookMyForex has emerged as India's most innovative foreign currency exchange service 8. · He wants to buy a stock named ABC and enters the market. The current market price is $10, the Bid price is $, and the Ask price is $ So, $ is the lowest price sellers are willing to sell the stock at, and $ is the highest price buyers are willing to buy the stock at 4. · Make no mistake, when it comes to buying and selling currency, the forex is the world’s premier destination. The currencies available to buy, sell, and trade on the forex are grouped according to three primary classifications: Majors: The majors are the eight largest and most frequently traded currencies in the world

No comments:

Post a Comment