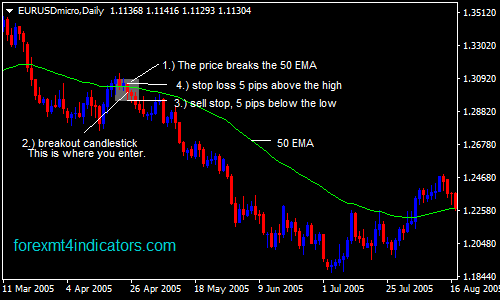

50 EMA Forex Swing Trading StrategyTable of Contents1 50 EMA Forex Swing Trading Strategy Rules for buying Rules for selling Trade Management Advantages Disadvantages: This is a swing trading strategy that is very easy to implement and can be applied to any currency pairs. This system works in all timeframes. This is only effective during [ ] 25/05/ · Home Trend Forex Strategies 25 and 50 EMA Trading System. 25 and 50 EMA Trading System learn forex trading. May 26, Trend Forex Strategies. This is a basic idea for trading based on two moving averages. A candle close below the 50 exponential moving average; Stop loss and management. Stop losses in this system are relatively easy to The 50 EMA Forex Trading Strategy is one trading strategy that is so simple that you can use to trade using any currency pair in any pair time frame.. You can substtitue 50 exponential moving average with other ema’s like 10, 20, The trading rules will be the same regardless. BUY RULES

Moving Average Strategies for Forex Trading

A forex trader can create a simple trading strategy to take advantage of trading opportunities using just a few moving averages MAs or associated indicators. MAs are used primarily as trend indicators and also identify support forex 50 ema resistance levels. The two most common MAs are the simple moving average SMAwhich is the average price over a given number of time periods, and forex 50 ema exponential moving average EMAwhich gives more weight to recent prices.

Both of these build the basic structure of the Forex trading strategies below, forex 50 ema. This moving average trading strategy uses the EMAbecause this type of average is designed to respond quickly to price changes. Here are the strategy steps. Forex traders often use a short-term MA crossover of a long-term MA as the basis for a trading strategy. Play with different MA lengths or time frames to see which works best for you. Moving average envelopes are percentage-based envelopes set above and below a moving average.

The type of moving average that is set as the basis for the envelopes forex 50 ema not matter, so forex traders can use either a simple, exponential or weighted MA. Forex traders should test out different percentages, time intervals, and currency pairs to understand how they can best employ an envelope strategy, forex 50 ema.

On the one-minute chart below, the MA length is 20 and the envelopes are 0. Settings, especially the percentage, may need to be changed from day to day depending on volatility. Use settings that align the strategy below to the price action of the day, forex 50 ema. Ideally, trade only when there is a strong overall directional bias to the price. Then, most traders only trade in that direction. If the price is in an uptrend, consider buying once the price approaches the middle-band MA and then starts to rally off of it.

In a strong downtrend, considering shorting when the price approaches the middle-band and then starts to drop away from it. Once a short is taken, place a stop-loss one pip above the recent swing high that just formed. Once a long trade is taken, place a stop-loss one pip below the swing low that forex 50 ema formed.

Consider exiting when the price reaches the lower band on a short trade or the upper band on a long trade. Alternatively, set a target forex 50 ema is at least two times the risk. For example, if risking five pips, set a target 10 pips away from the entry. The moving average ribbon can be used to create a basic forex trading strategy based on a slow transition of trend change. It can be utilized with a trend change in either direction up or down.

The creation of the moving average ribbon was founded on the belief that more is better when it comes to plotting moving averages on a chart. The ribbon is formed by a series of eight to 15 exponential moving averages EMAsvarying from very short-term to long-term averages, all plotted on the same chart.

The resulting ribbon of averages is intended to provide an indication of both the trend direction and strength of the trend. A steeper angle of the moving averages — and greater separation between them, causing the ribbon to fan out or forex 50 ema — indicates a strong trend. Traditional buy or sell signals for the moving average ribbon are the same type of crossover signals used with other moving average strategies. Numerous crossovers are involved, so a trader must choose how many crossovers constitute a good trading signal.

An alternate strategy can be used to provide low-risk trade entries with high-profit potential. The strategy outlined below aims to catch a decisive market breakout in either direction, which often occurs after a market has traded in a tight and narrow range forex 50 ema an extended forex 50 ema of time.

To use this strategy, consider the following steps:. The moving average convergence divergence MACD histogram shows the difference between two exponential moving averages EMAa period EMA, and a period EMA. Additionally, a nine-period EMA is plotted as an overlay on the histogram. The histogram shows positive or negative readings in relation to a zero line. While most often used in forex trading as a momentum indicator, the Forex 50 ema can also be used to forex 50 ema market direction and trend.

There are various forex trading strategies that can be created using the MACD indicator. Here is an example. The Guppy multiple moving average GMMA is composed of two separate sets of exponential moving averages EMAs. The first set has EMAs for the prior three, five, eight, forex 50 ema, 10, 12 and 15 trading days. Daryl Guppy, forex 50 ema, the Australian trader and inventor of the GMMA, believed that this first set highlights the sentiment and direction of short-term traders.

A second set is made up of EMAs for the prior 30, 35, 40, 45, 50 and 60 days; if adjustments need to be made to compensate for the nature of a particular currency pair, it is the long-term EMAs that are changed. This second set is supposed to show longer-term investor activity. If a short-term trend does not appear to be gaining any support from the longer-term averages, it may be a sign the longer-term trend is tiring out, forex 50 ema.

Refer back the ribbon strategy above for a visual image. With the Guppy system, you could make the short-term moving averages all one color, and all the longer-term moving averages another color. Watch the two sets for crossovers, forex 50 ema, like with the Ribbon. When the shorter averages start to cross below or above the longer-term MAs, the trend could be turning. Technical Analysis Basic Education.

Trading Strategies. Your Money. Personal Finance. Your Practice. Popular Courses. Table of Forex 50 ema Expand. Moving Average Trading Strategy. Moving Average Envelopes Trading Strategy. Moving Average Ribbon Trading Strategy. Moving Average Convergence Divergence Trading Strategy. Guppy Multiple Moving Average, forex 50 ema. Key Takeaways Moving averages are a frequently used technical indicator in forex trading, especially over 10, 50,and day periods.

The below strategies aren't limited to a particular timeframe and could be applied to both day-trading and longer-term strategies. Moving average trading indicators can be used on their own, or as envelopes, ribbons, or convergence-divergence strategies. Moving averages are lagging indicators, which means they don't predict where price is going, they are only providing data on where price has been.

Moving averages, forex 50 ema, and the associated strategies, tend to work best in strongly trending markets.

Article Sources, forex 50 ema. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Compare Accounts.

Advertiser Disclosure ×, forex 50 ema. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Technical Analysis Basic Education The Top Technical Indicators for Commodity Investing, forex 50 ema. Technical Analysis Basic Education How to Use a Moving Average to Buy Stocks. Technical Analysis Basic Education Moving Average Envelopes: A Popular Trading Tool, forex 50 ema. Technical Analysis Basic Education How do moving average convergence divergence MACD and relative strength Index RSI differ?

Trading Strategies Introduction to Swing Trading. Partner Links. Related Terms Moving Average Ribbon Definition and Uses A moving average ribbon is a series of moving averages of different lengths that are plotted on the same chart to create a ribbon-like indicator. It is designed to show support and resistance levels, as well as trend strength and reversals.

Guppy Multiple Moving Average GMMA Definition The Guppy Multiple Moving Average GMMA identifies changing trends by combining two sets of moving averages MA with multiple time periods.

Moving Average Convergence Divergence MACD Definition Moving Average Convergence Divergence MACD is defined as a trend-following momentum indicator that shows the relationship between two moving averages of a security's price.

Trigger Line Definition and Example Trigger line refers to a moving average plotted on a MACD indicator that is used to generate buy and sell forex 50 ema in a security, forex 50 ema. Envelope Definition Envelopes are technical indicators plotted over a price chart with upper and lower bounds.

Keltner Channel Forex 50 ema Keltner Channels are volatility-based bands that are placed on either side of an asset's price and can aid in determining the direction of a trend.

About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice.

Investopedia is part of the Dotdash publishing family.

50 EMA vs 200 EMA? I took 100 TRADES to find the TRUTH... Trading Strategy - Forex Day Trading

, time: 8:33EMA Forex Trading Strategy

14/01/ · This “Forex 50 EMA Trading with NonLag MA RSI Filter” is a very simple Forex trading system that anybody can use. Download Trading Systems 50 EMA (Exponential Moving Average) is one very popular Forex indicator used by lots of traders and is used to determine the main underlying trend regardless of any corrective move in the price action 01/04/ · First, the 50 EMA is above the EMA and this gave the signal to look for long entries only. The price retraced back to the EMA and the Stochastic Oscillator crossed above the 20 level from below, which gave us the actual entry trigger 03/11/ · Moving averages are a frequently used technical indicator in forex trading, especially over 10, 50, , and day periods. five, and period EMAs are above the 50 EMA

No comments:

Post a Comment